Inventory is the most valuable asset on the balance sheet for product-based businesses. As is the case, improving gross margins by 1% or delaying future inventory operations hires drives a meaningful business impact. This article expounds upon how businesses use technology to manage purchase orders (PO) today, analyzes specific gaps in how ERP systems manage the PO process, and offers recommendations for a more efficient and digitized purchase order flow.

The Present State of Purchase Order Management

A common question COOs, CFOs, and Supply Chain Managers analyze is: “how much does it cost my business to process and manage a purchase order?” While it is challenging to come up with a clear-cut answer, several firms have conducted research projects to understand this question’s answer. Below are findings from two of the better-known studies:

- American Productivity & Quality Center (APQC) – This agency conducts many supply chain research projects. In November 2020, they published data on businesses’ total cost to complete the average purchase order process. APQC surveyed businesses across various industries (consumer goods, industrial manufacturing, petroleum, etc.), and they found the average purchase order process is costing companies from $35.88 – $506.52/PO. They also published literature regarding the average cost per $1,000 PO. These costs ranged from $5.37-$28.09. Looking at these metrics from a different angle, one can deduce that it costs a business .6 cents – 3 cents per $1 of PO value.

- Center for Advanced Procurement Strategy (CAPS) – CAPS’ research numbers are relatively similar to the findings of APCQ and show the cost for the average purchase order ranges from $50-$1,000 based on industry and vertical.

The above metrics account for costs stemming from internal purchase order requisition and execution, external (factory) purchase order processing, confirming ship dates and order requirements, receiving and confirmation of accurate product, invoice processing, and sorting out any errors throughout these processes. The above metrics do not include the costs associated with finding, trialing, and onboarding new vendors, nor do they factor in product design/sampling costs or costs related to demand planning. In addition to the costs captured in these studies, teams spend hundreds to thousands of additional hours sourcing new vendors, calculating demand plans, etc. It is important to note as the metrics above do not include this time/cost.

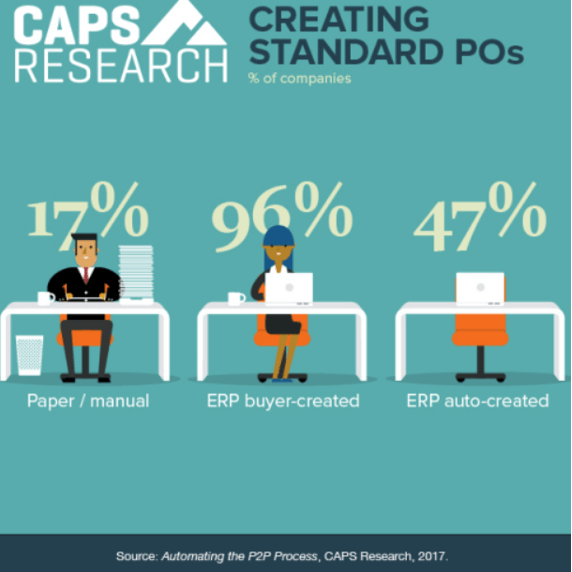

Now that we have explored what present-day PO management processes are costing businesses, it is natural to analyze how and with what systems companies are currently managing POs. The below infographic from CAPS shows data on how enterprise businesses most commonly create and manage standard POs. Participants could select multiple answers, and the below three buckets were the most common responses.

If we look first at the 17% paper/manual PO management, some industries simply do not and will not use technology. This bucket includes businesses that strictly leverage email, phone, and paper to process orders. However, these legacy companies represent a minority of businesses. The next two metrics show us that most of our world has already made a conscious effort to digitize PO execution. However, it is interesting that less than half of these ERP users leverage PO automation capabilities.

A whopping 96% of enterprise businesses leverage ERP systems to capture POs. This article’s purpose is NOT to infer that 96% of companies are wrong for doing so. I spent the last 5.5 years at Netsuite, where I helped hundreds of consumer product businesses onboard new ERP systems. During that time, I realized that while enterprise companies needed ERP systems, they needed additional software to manage the end-to-end supply chain. This blog explains where ERP functionality leaves off, and manual intervention begins. Tools exist today that act as a wrapper around your existing ERP system to provide superior and more holistic PO automation, digitization, and tracking.

Where are ERPs Strong?

ERPs are excellent (generally speaking) at accounting, baseline inventory management, and dashboard level reporting/insights. By accounting, I mean managing AP & AR, expense reporting, period close, payroll, and primary financial statements (income, cash flow, balance sheet, corporate budget). By baseline inventory, I mean executing (booking) purchase orders, marking merchandise received into stock, tracking inventory levels as orders decrease available supply, and managing basic pick/pack/ship workflows. By dashboard level reporting, I mean that ERPs do a good job of providing summary business insights to a wide range of business participants.

Why Businesses Avoid ERP Customizations

While ERPs effectively cast a wide net and add valuable functionality in a wide variety of process areas, people with a less favorable opinion on ERPs say they are “jacks of all trades and masters of none.” There is some merit to this point of view, as in the ERP world, “customization” is a dirty word. A high percentage of the projects I took on while in the ERP world required customizations to accomplish tasks that were not native to the platforms.

When evaluating ERPs or considering updating your current ERP, when you hear the word “customization” or “scripting,” it is generally followed by a quote for hundreds of hours billed at $150-$300/hr rates to build a seemingly menial workflow. Because every single record/object in an ERP is dynamically linked back to the chart of accounts, customized workflows, objects and forms take a while to architect. The ERP would break if the build were done improperly or rushed. As an ERP stores the business’s financial and proprietary information, it is very unwise to layer on customizations lackadaisically. Custom fields are relatively easy add-ons to ERPs, but custom-built workflows, objects, and reports are not simple or small tasks. To effectively manage the PO process end-to-end in an ERP, customizations AND extending access to external parties is required.

Why Businesses Do Not Extend ERP Access to External Parties

Businesses should not and generally speaking do not like to extend ERP access to suppliers or vendors because doing so risks an external party getting access to financial data, or worse, inputting bad data. ERPs generally have a good architecture and segmentation of roles/permissions. Still, it takes hours of configuration for an administrator to custom build a role where a vendor can only access certain fields only on their specific inflight POs. In addition to the added risk of opening access to third parties, the average ERP user costs between $50/user/mo – $120/user/mo, so it is not surprising that businesses seldom grant user access to vendors. Another option some companies consider is custom integrating directly to vendors/suppliers. Still, integrations are even more costly than ERP users, they need to be maintained ($), and there can be a lot of them as the average company has hundreds of suppliers in their network.

I mention the above points about ERP customizations and extending access to external parties because, natively, ERPs as standalone internal systems have several shortcomings regarding PO management. Let’s look at four specific processes involved in PO management that ERPs do not natively possess:

1) Communication and Collaboration

2) WIP/Status Tracking

3) Demand Planning

4) Supply Chain Marketplace.

Communication & Collaboration

ERPs certainly do not possess a Slack or Zoom-Esque feature set where you can communicate and collaborate with internal and external supply chain participants. ERPs are somewhat useful in routing and executing internal tasks and approvals, but access to an ERP generally stays within the specific business or organization. In considering a PO process, the PO’s physical execution is just the tip of the iceberg that triggers a whole bunch of downstream communication. For example, when I worked for Blaze-In Sportswear, I managed hundreds of thousands of units within a PO. At that time, I cannot remember a single order where we did not have to get on the phone and/or exchange numerous emails. Whether it was confirming order acknowledgments, factory receipt of raw materials, size/SKU/quantity breakdowns, or shipping/freight carriers, hours of back-and-forth communication was inevitable.

Furthermore, factories have a wide variety of preferred communication methods. By this, I do not only mean avenues like email, phone, WhatsApp, Wechat, Zoom, EDI, etc., but I also mean native languages and time-zones. How much more efficient and streamlined would your PO process be if you had multi-lingual communication tracked and layered on top of your physical POs? Solutions like the Suuchi GRID do just this! Without a supply chain management platform, ERPs will attempt to solve this challenge with integrated email services. However, these email integrations are very ineffective as the average business has more than one open PO with the same vendor at the same time. With so many internal and external participants touching a PO, new email addresses working on multiple coterminous POs make ERP email integrations ineffective. Emails start getting tagged to different POs with the same vendor making it impossible to have a centralized communication chain on all things related to one specific PO.

ERP systems also have a data storage limit, limiting how centralized all documentation can be. For example, if you produce an intricate garment or complex electrical product, high-resolution images are essential to share as you communicate POs to your vendors. If there is a limit on data storage, high-res images will eat away at available space and reduce the amount of documentation stored in a central location for future projects.

WIP Tracking

If I had a dollar for every client that asked if NetSuite could track the status of inflight POs, I would be a very wealthy man. Every Supply Chain Manager has the goal of having a beautiful dashboard that shows every PO filterable by the product, status, vendor, and line of business. In concept, yes, any ERP can add a custom field to a purchase order called “status,” and there can be drop-down options for “order received,” “in progress,” “cutting,” “stitching,” “finishing,” “shipped to the client,” and “received.” The fact of the matter is that few vendors will build their whole process around your system. No vendor will tediously update your system every day. Even if they did, what happens if they make a mistake and incorrectly update? Remember how much ERP users cost?

99% of the time, when ERP users customize their PO form and open access up to external parties, they end up reverting to manual email-driven communication with their suppliers. ERPs were not architected to democratize access to the supply chain system. The next-generation of supply chain platforms allow factories to seamlessly integrate their methods into your platform to create the dream WIP/PO status dashboard.

Demand Planning

ERPs are also sufficient for very basic demand planning. For example, I can program my ERP to tell me when I drop below ‘X’ units of product ‘Y,’ trigger a reminder on my dashboard. I can even take this concept to the next level and theoretically automate my PO process by having my ERP automatically recommend and execute a PO (cautionary red tape here). By this, I mean my ERP can trigger a purchase order pending approval for the ‘Z’ quantity of ‘Y’ product when I drop below ‘X’ units. ERPs do this using the concept of min/max/preferred stock level planning.

While this is great in theory, the reality is that this demand planning model is artificial and lacks some of the essential criteria buyers consider when executing POs. For example, what happens if I have two or more vendors from which I can purchase the same product? What if I have a vendor in China that is more effective for low-cost bulk POs but a more agile partner who provides superior lead times and service in South America? My ERP does not account for these outside metrics, and so I need to set a preferred vendor in my ERP and need to intervene manually, or worse, I may accidentally trigger POs I did not mean to execute.

An additional consideration is what if the optimal stock level for a particular product changes? If you are a growing business, some of your products will inevitably sell-thru at a higher velocity than others, and this sell-thru rate will change over time. The ERP is ok for a “set it and forget” approach where you set preferred stock levels and reorder points. However, when buying products, there is a lot more analysis and a lot less consistency in the buying process and setting a reorder point is insufficient. A common example where this concept breaks down is in seasonal businesses that do not incorporate an evergreen or never out product model. For instance, there are new skis and boots in the skiing vertical every year, so you likely only order each SKU once or twice. You could purchase the same quantity year over year of the new version of the product coming out, but that is blindly believing next year will hold the same trends as the prior year. What about your company’s growth rate? What if Atomic’s 2021 model is superior to K2’s? A trend may emerge where consumer demand increases for longer and fatter skis, and neither provider is a viable option.

When it comes to demand planning, whether you are planning Nestle nerds ropes, skis, or handbags, there is a lot of bottom-up, top-down, and scenario planning before executing any POs. None of this happens in an ERP.

Supply Chain Marketplace (identifying new vendors)

ERP systems like Oracle, SAP, and NetSuite are just now beginning to build marketplaces within their ERP ecosystem. However, these marketplaces are generally listing other software companies with specific functionality in a particular segment that can be layered on top of the ERP. These marketplaces do not list vendors, and factories like Alibaba or Seller’s Central does. How great would it be to submit a virtual bid where all potential suppliers in your network AND the marketplace can respond and bid out your PO for the best price, quality, and lead time? These virtual marketplaces are the future and where supply chains are headed.

An ERP system alone does not optimize purchase order management, but it effectively manages some of the fundamental steps in the PO management process. An ERP system makes the finance and accounting team happy as they have AP visibility. Still, the everyday supply chain participants doing the leg work to execute on a successful inventory purchase are left picking up the pieces across disparate systems and communication modes.

To WAY over generalize, there are two types of businesses: pre-ERP businesses and post-ERP businesses. If you run a lean pre-ERP business, investing early-on in a supply chain digitization platform will free-up bandwidth and delay the need to make a considerable investment in a time-consuming ERP roll-out. If you run a post-ERP business and have been on your ERP for over a year, you likely have discovered several shortcomings. You are probably considering layering different tools on top to accomplish the vision you initially thought your ERP would. A supply chain digitization platform can delay future headcount hires and improve margins because you will get real-time updates and data without adding any extra manpower. With this data at your fingertips, you can roll out smart factory assignments, bid out engagements, get ahead of bottlenecks, and be in control rather than at the whims of your supply chain partners.